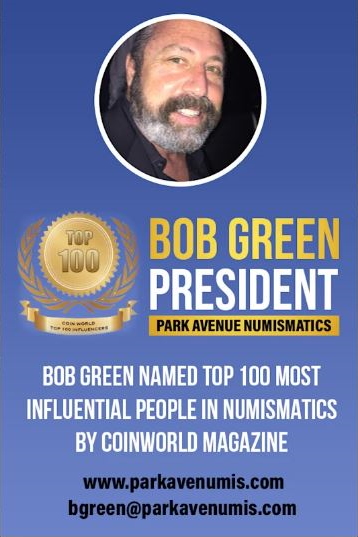

Park Avenue Numismatics

5084 Biscayne Blvd, Suite 105

Miami, FL 33137

Toll Free: 888-419-7136

Secure Private Ordering

We use the latest online security processing,

so your order is safe & private.

We DO NOT disclose any customer

information to ANY third party company.

Our customer privacy is our priority.

Over 30 Years Experience

Park Avenue has over 30 years

experience buying and selling

Rare Coin and Precious Metals.

We have the knowledge and

ability to provide our customers

with the best products and services.

Escaping the dollar's gravitational pull

6.1.23 - Escaping the dollar's gravitational pull

Gold last traded at $1,977 an ounce. Silver at $23.87 an ounce.

The developing world wants to escape the dollar's gravitational pull by shifting more reserves to gold -Yahoo!Finance

Often at the mercy of the dollar, emerging countries are looking to insulate themselves from the vagaries of U.S. Federal Reserve policy by shifting to gold-and away from the greenback.

This shift in their currency reserves poses a distinct risk to Americans, who benefit from the willingness of other countries to swap their goods in exchange for U.S. legal tender. If more nations trade among themselves using other currencies such as the Chinese yuan, the U.S. Treasury will be forced by this "de-dollarization" to pay higher interest when borrowing from foreign creditors.

Now, it appears developing countries are indeed looking to lower their dependence on the dollar, according to the results of an annual survey of central banks conducted by the World Gold Council and published on Tuesday.

The industry association, which represents some of the largest miners of the metal including Barrick Gold, Newmont, and AngloGold Ashanti, discovered a "gulf in thinking" between the monetary policymakers in advanced economies and those in developing markets. The outcome has major implications for the United States and its ability to fund large and persistent trade deficits-and therefore American living standards.

"This divergence of views is perhaps most striking in terms of the outlook for the U.S. dollar and gold," the World Gold Council's annual report said. Developing economies, which the group says have been the primary driver of gold buying since the 2008 global financial crisis, "appear to be more pessimistic about the U.S. dollar's future and more optimistic about gold's."